Oil Depletion

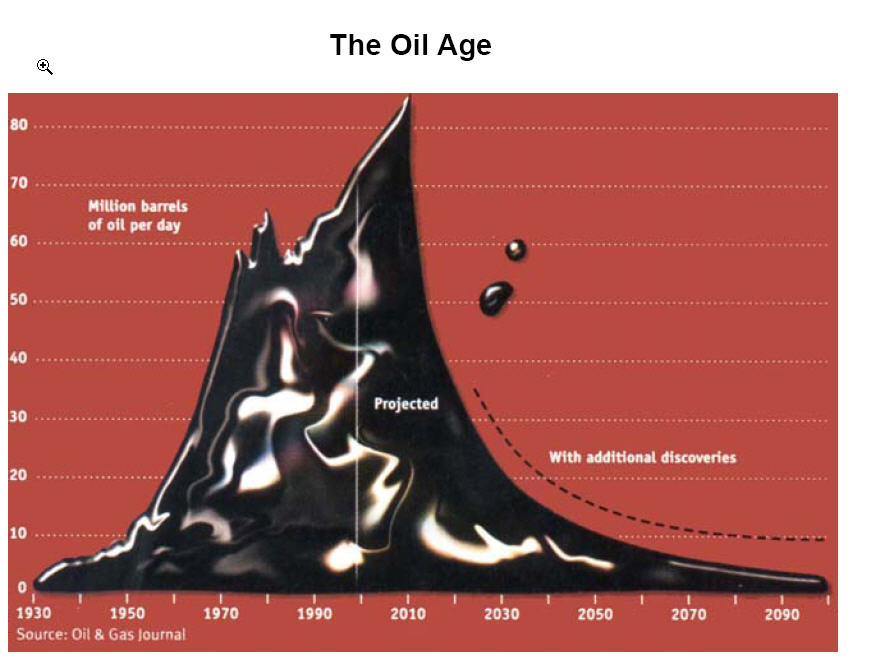

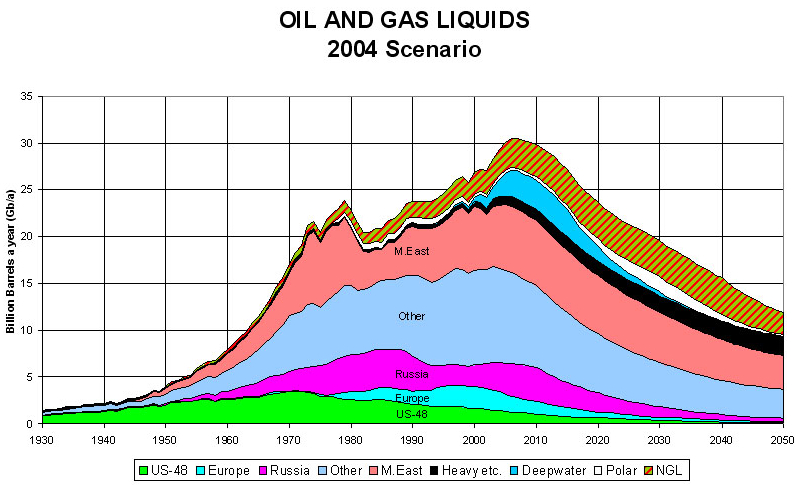

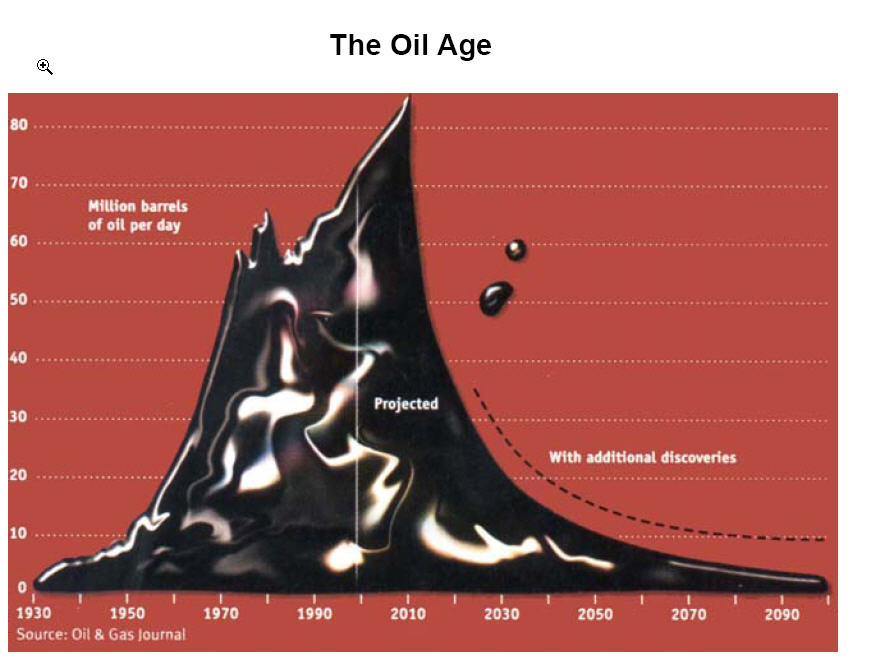

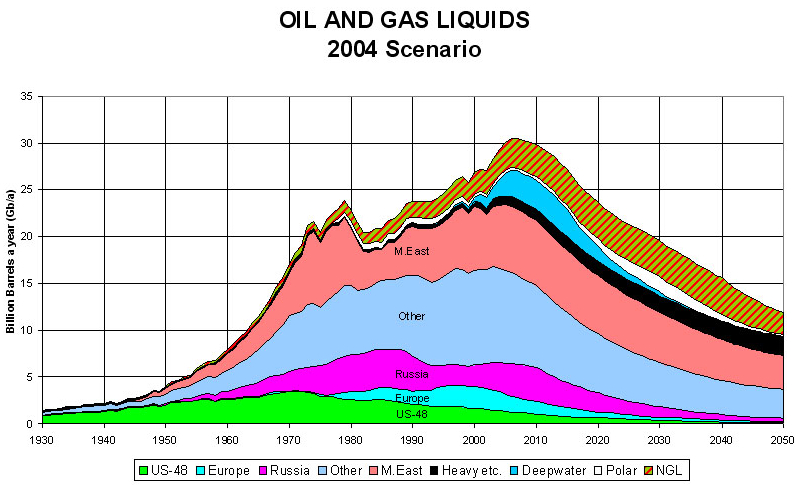

Worldwide Peak production is now (2005) instead of

earlier as a result

of deepwater tapped sources.

Worldwide Peak production is now (2005) instead of

earlier as a result

of deepwater tapped sources.

However,

the "peak" image is probably misleading as its likely are now entering

a "plateau" era of constant oil distribution (at about 84 million barrels

a day)

mining of unconventional sources helps a

little bit, but only a little bit

mining of unconventional sources helps a

little bit, but only a little bit

Rising Demand in India and China could well accelerate

the depletion producing the waveform seen in the first image above.

Rising Demand in India and China could well accelerate

the depletion producing the waveform seen in the first image above.

When Does the Oil Run Out?

What do we do then?

Pump more out?

but alas, its been pumped out!

And Discovery is plummetting:

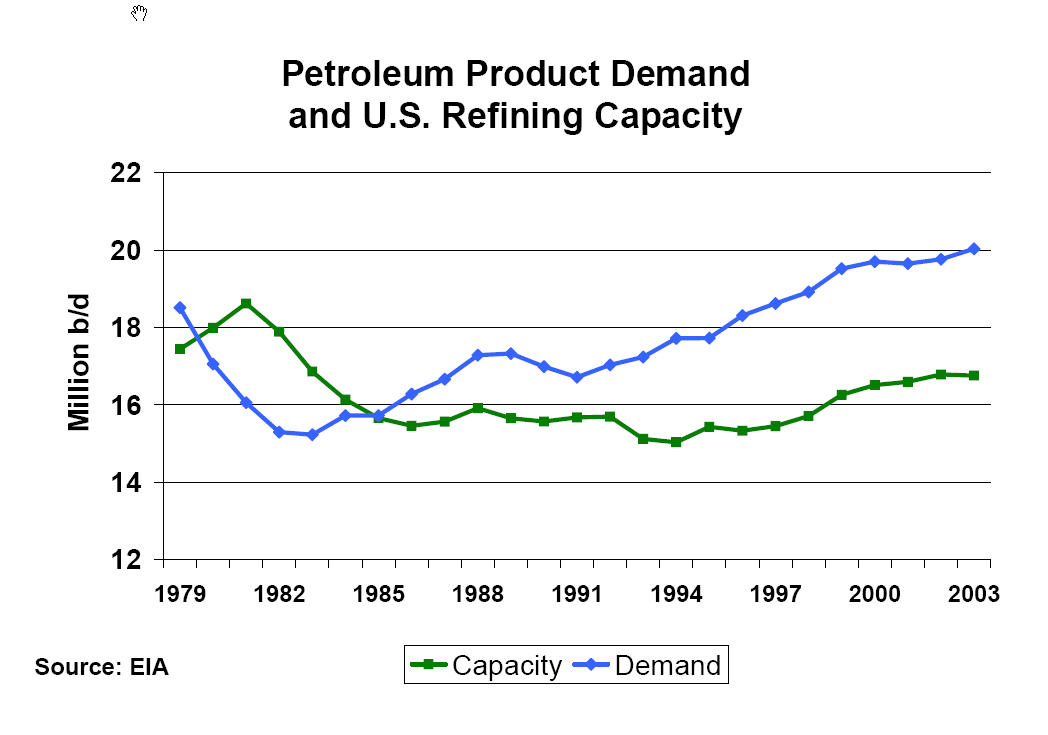

The US Demand for Oil is about 18-20 MBD (millions of barrels per day)

and 8.8 of that is for Gasoline.

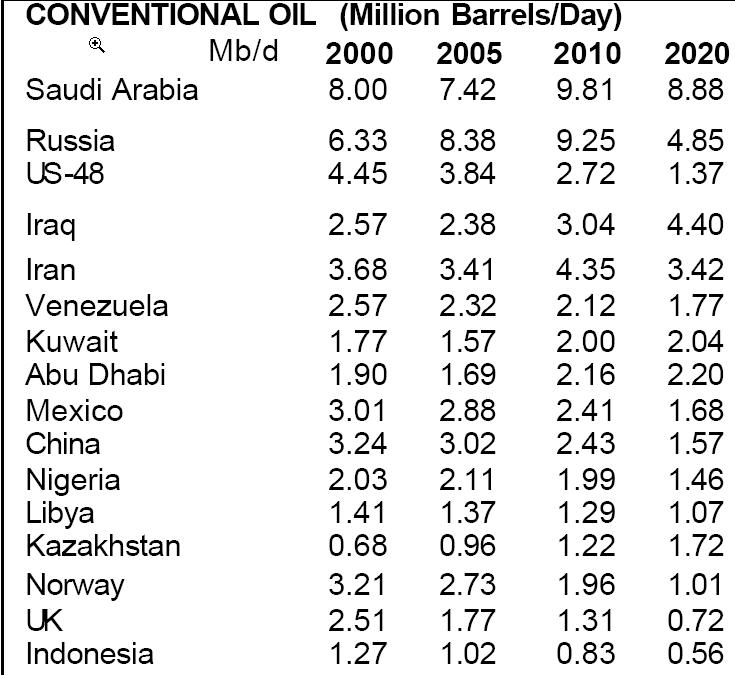

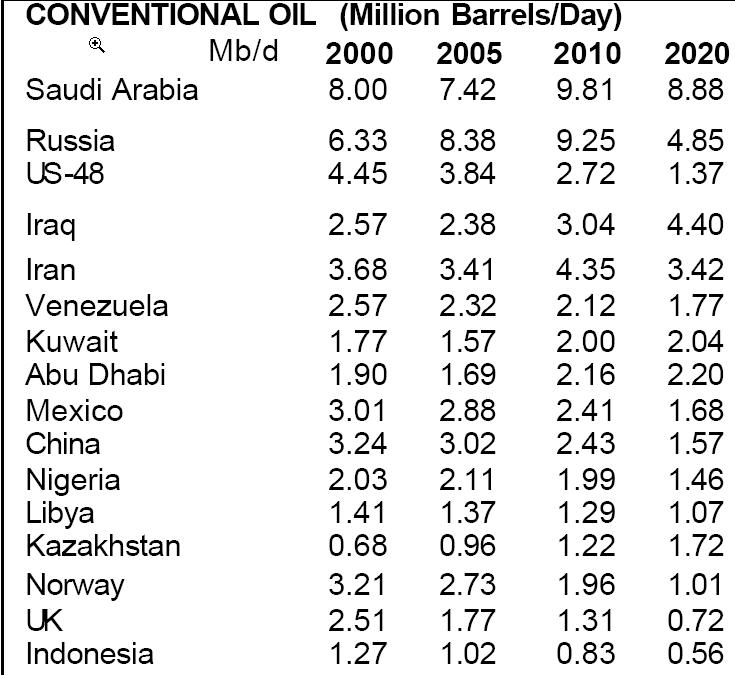

Here is the current production, as function of country, for the leading

oil producers in the world extrapolated out to 2020. Note the behavior

of Russia.

Our Current Import Pathways:

Fossil Fuel Use By Type is expected to Vary significantly in the

near future:

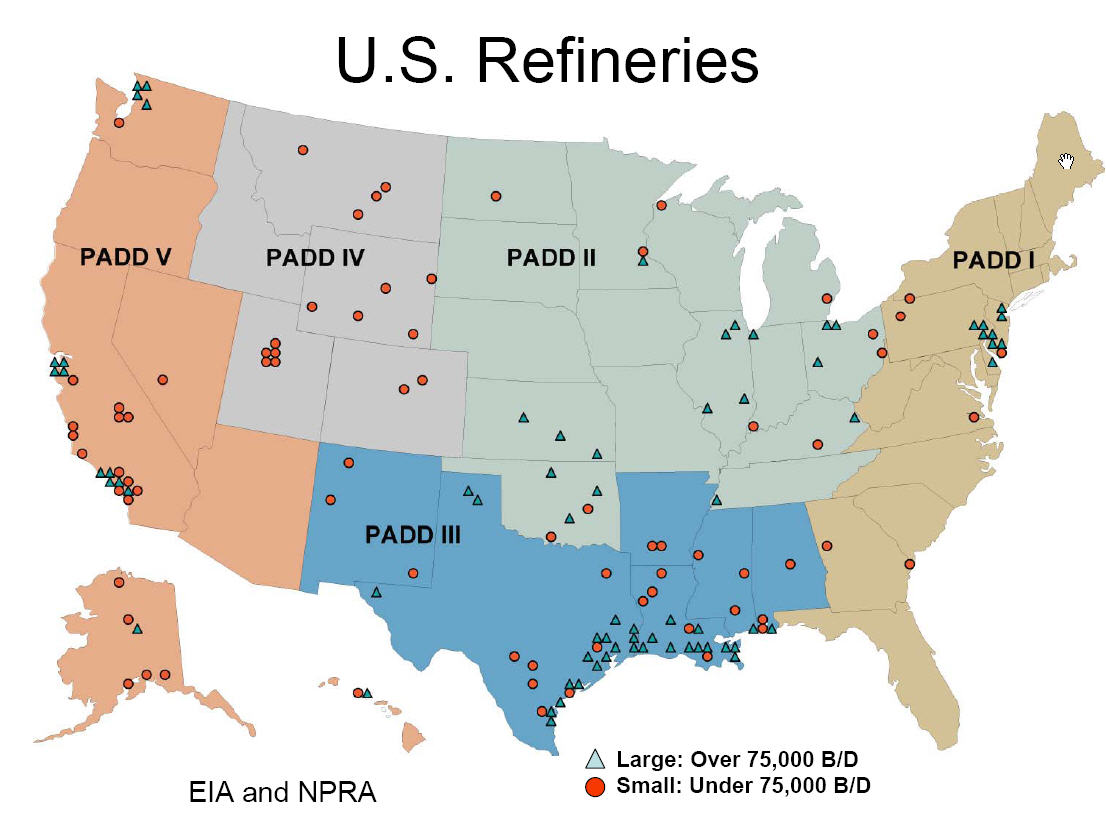

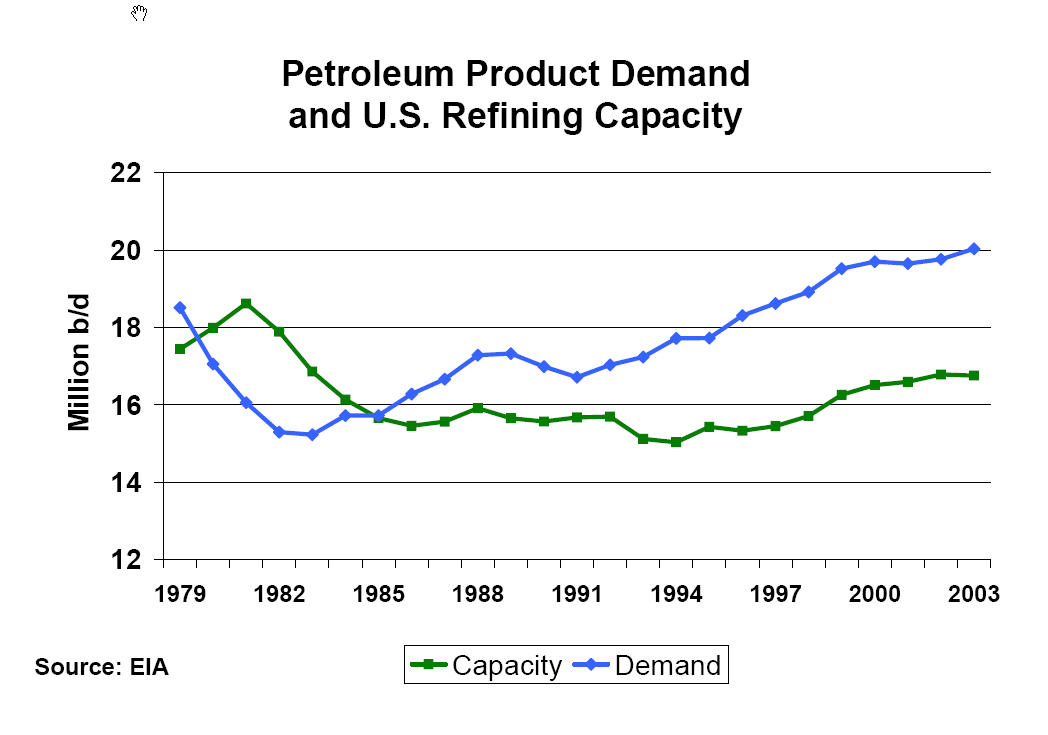

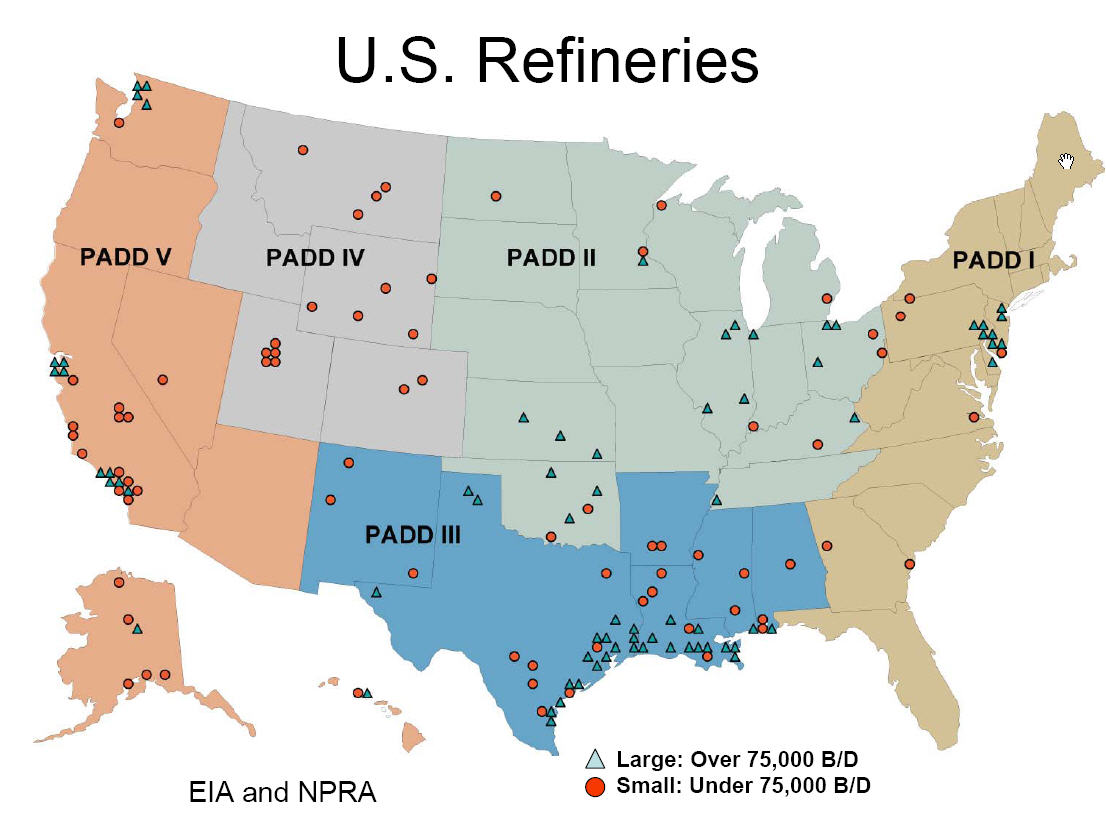

In the United States however, the worldwide demand for oil is not the

main problem. The problem is an aging and inadequate infrastructure for

refining crude oil.

The last refinery built in the US was in 1976 and its extremely unlikely

that any new refinery facilities will be built. This basic and simple

points, that the distribution of gasoline in the US is refinery limited is

something that neither the lay public nor congress seems to fully

grasp and this is the single biggest source of price fluctuations in the US.

Decline, Decline Decline:

Gasoline demand currently averages approximately 9 million barrels per day. Domestic refineries produce about 90 percent of U.S. gasoline supply, while about 10 percent is imported. Increased gasoline demand can be met only by increasing domestic refinery production or by relying on more foreign gasoline imports.  but in about 3 years, that 10% won't be there because foreign

providers will not be able to meet our "clean" air standards.

but in about 3 years, that 10% won't be there because foreign

providers will not be able to meet our "clean" air standards.

So you heard it hear first. By 2009, the US will

have a serious gasoline distribution problem if demand does not abate

and/or fuel economy does not increase.

Note: Merely driving 10% less solves this problem.

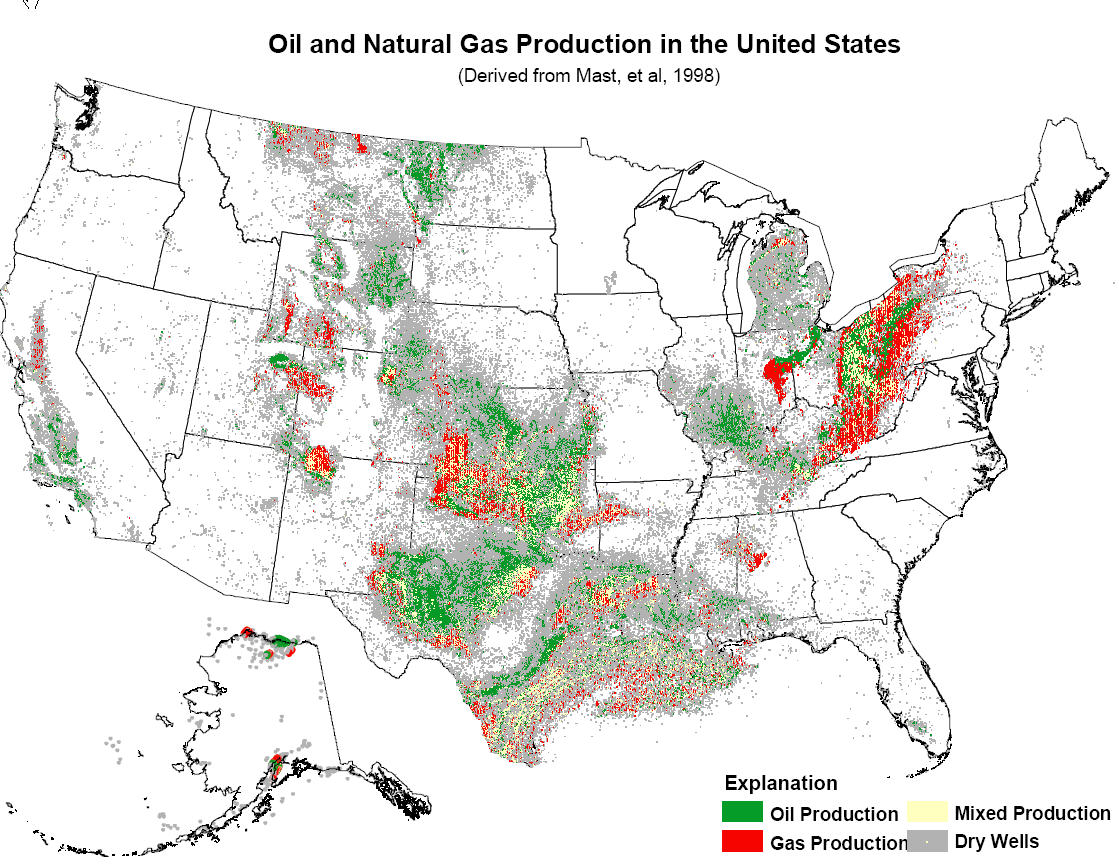

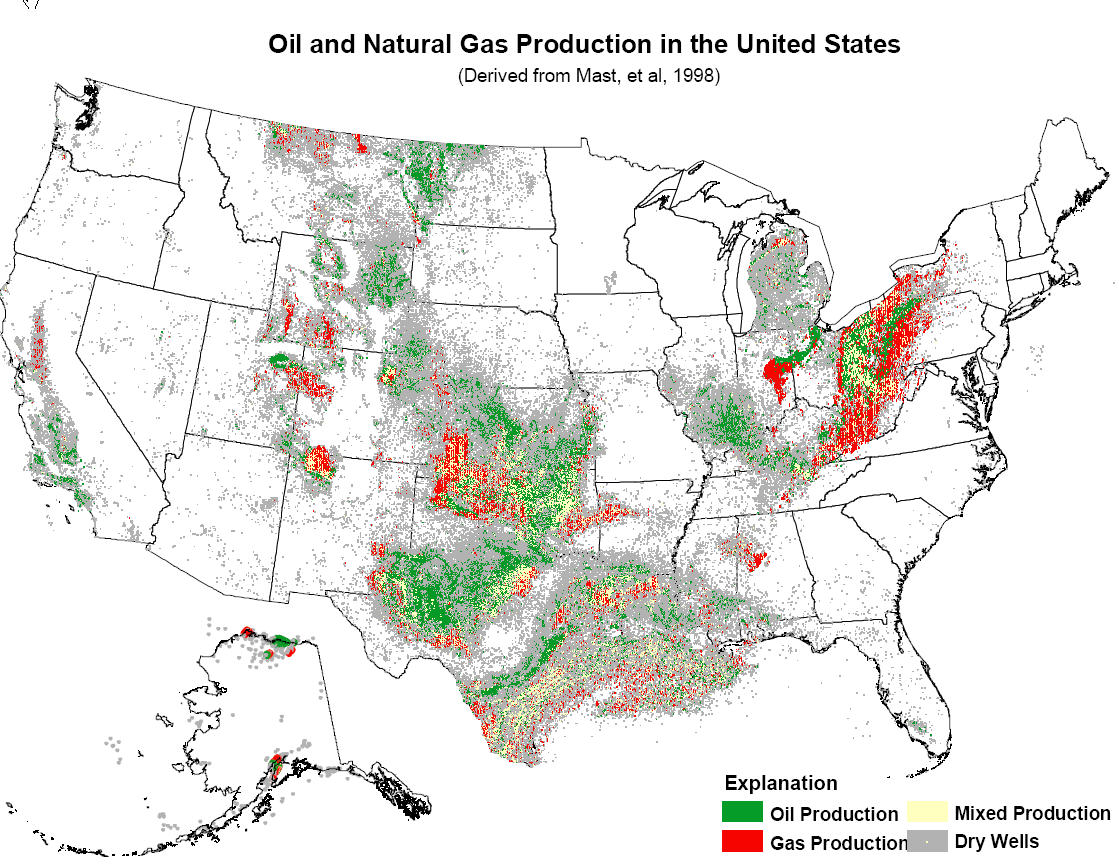

Distribution of Facilities in the US:

Naturally follows closely where its produced:

PADD's setup in World War II to help with alloction of gasoline:

Worldwide Peak production is now (2005) instead of

earlier as a result

of deepwater tapped sources.

Worldwide Peak production is now (2005) instead of

earlier as a result

of deepwater tapped sources.