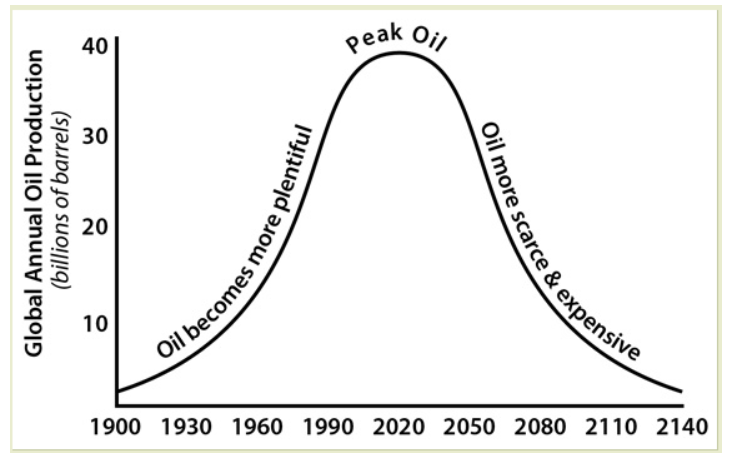

The issue of "Peak Oil" better termed as the crude oil exhaustion or depletion curve, is not as simple as the Peak Oil curve that you have been told is the reality:

This complication is due to a number of factors:

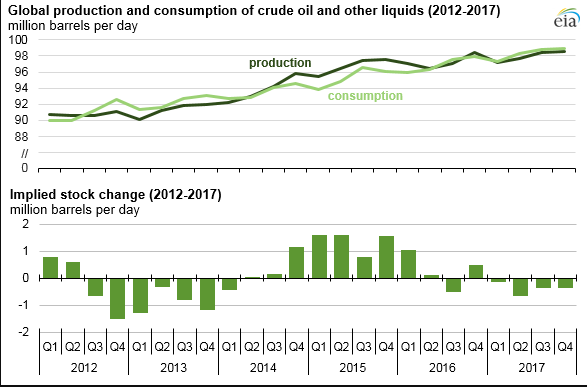

- There are conditions of temporary oversupply , by up to 1 MBD, on the global market as we have no ability to store cruide oil. This means the price is depressed because this extra inventory has to be sold (liquidated).

- Climate change mostly in Northern Europe is now producing warmer winters which is lowering the demand for heating oil.

- Refining output has slightly increased to meet demand. Some of this is done with new facilities that have recently come on line: (note the 2015 gap between production and consumption

as highlighted here )

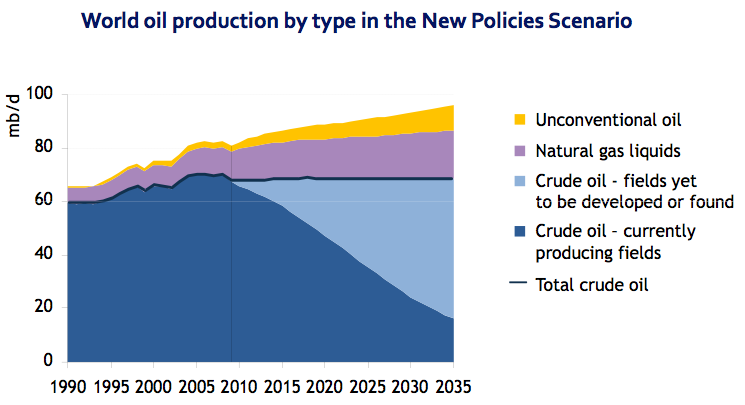

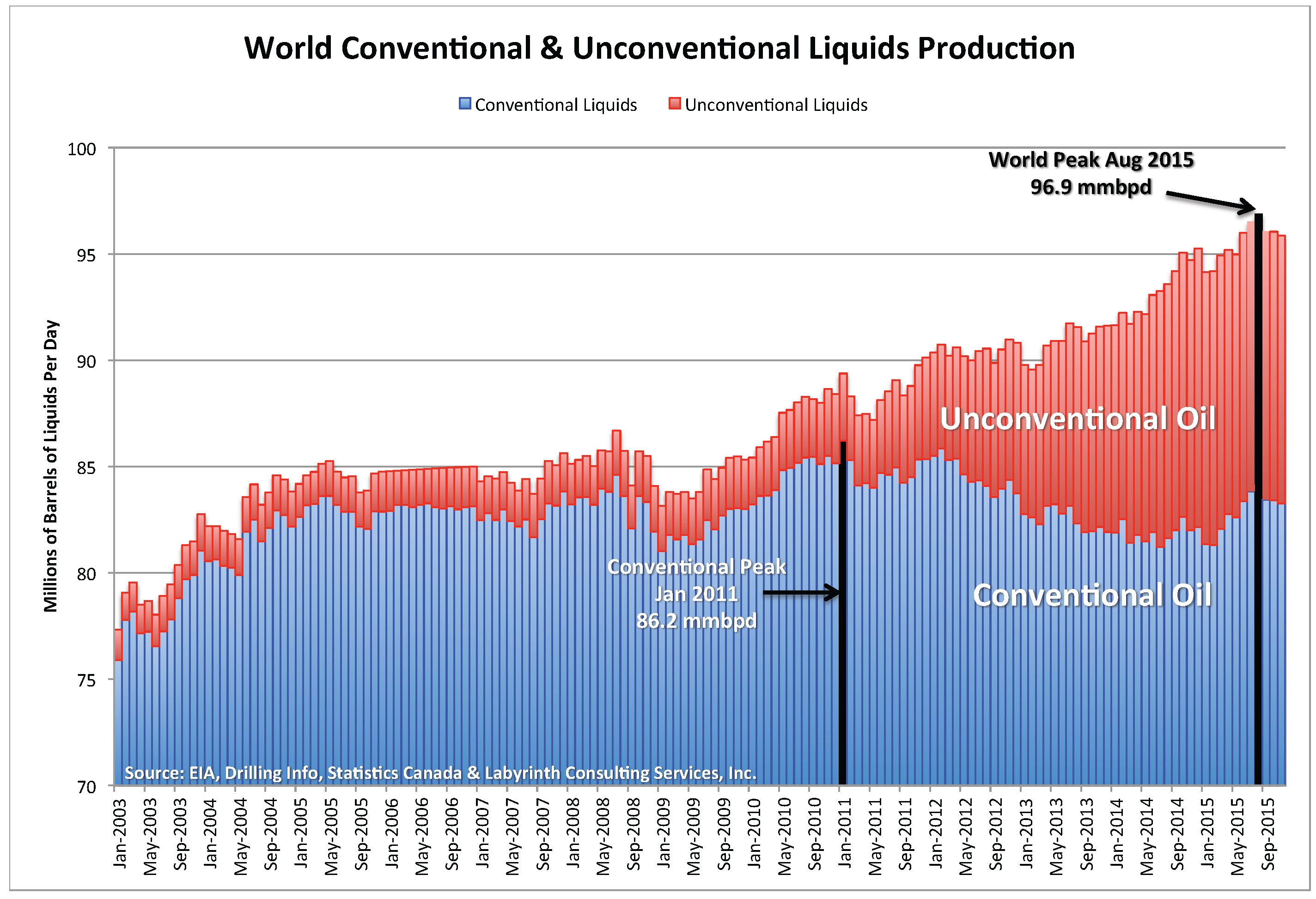

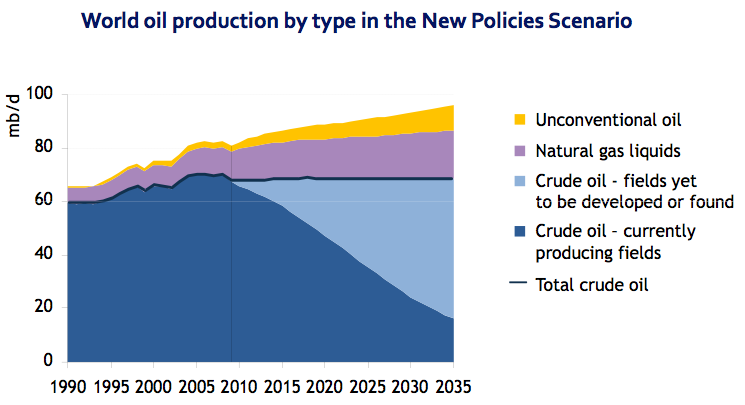

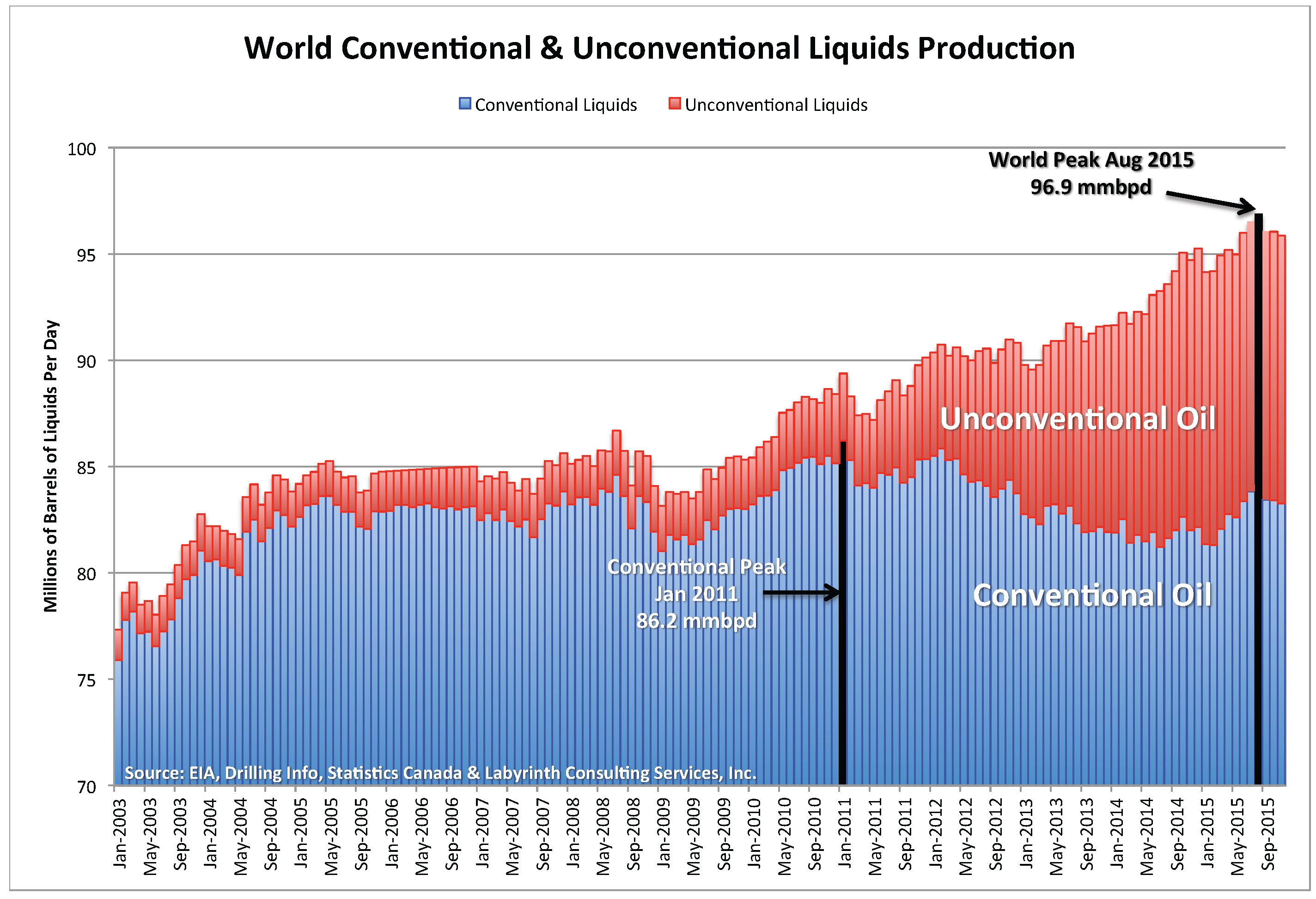

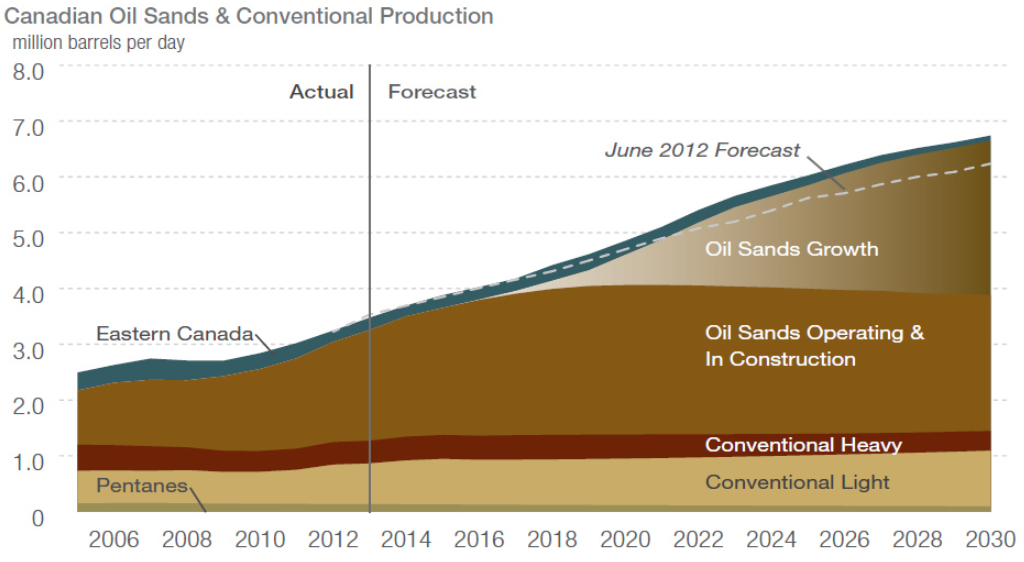

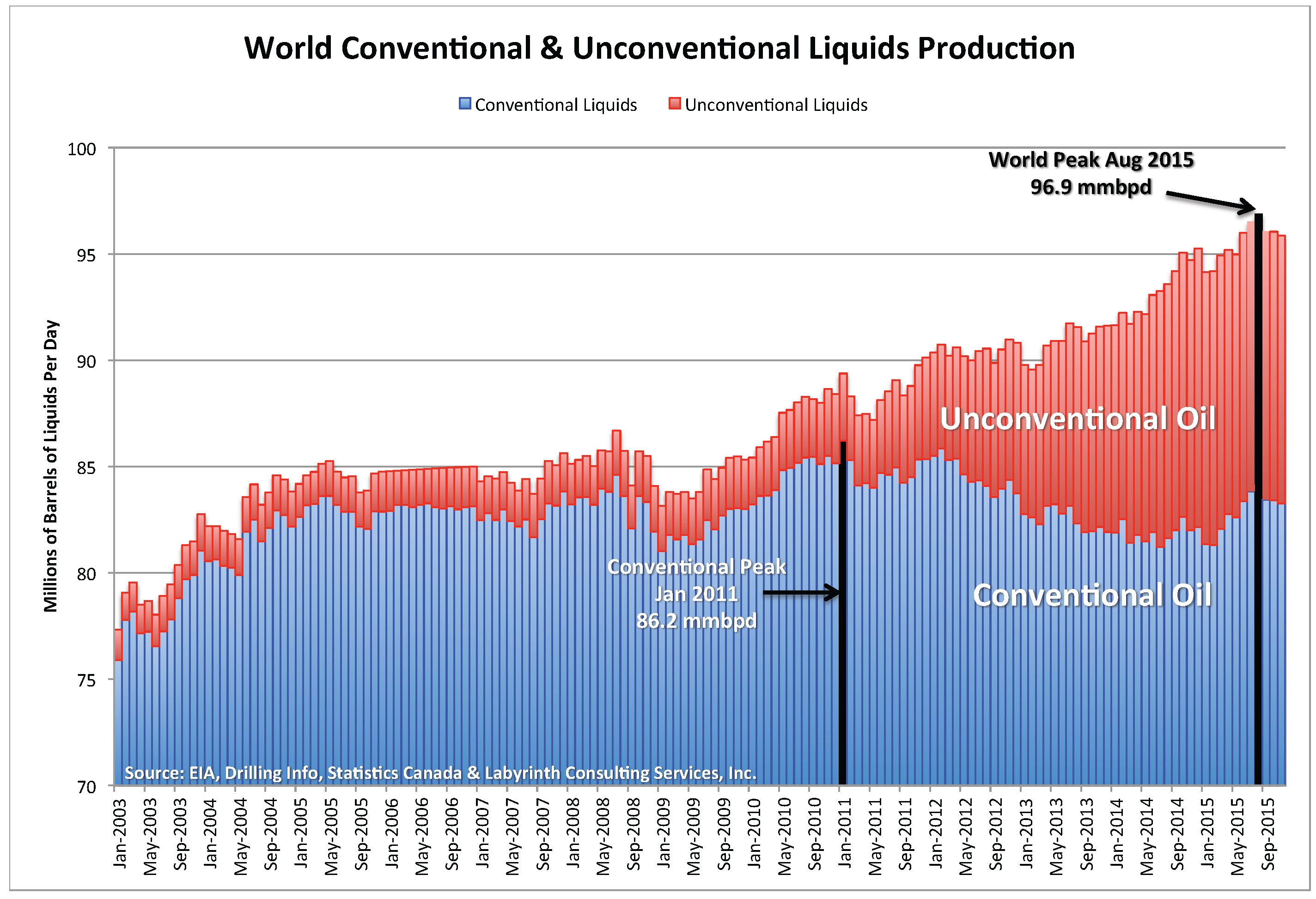

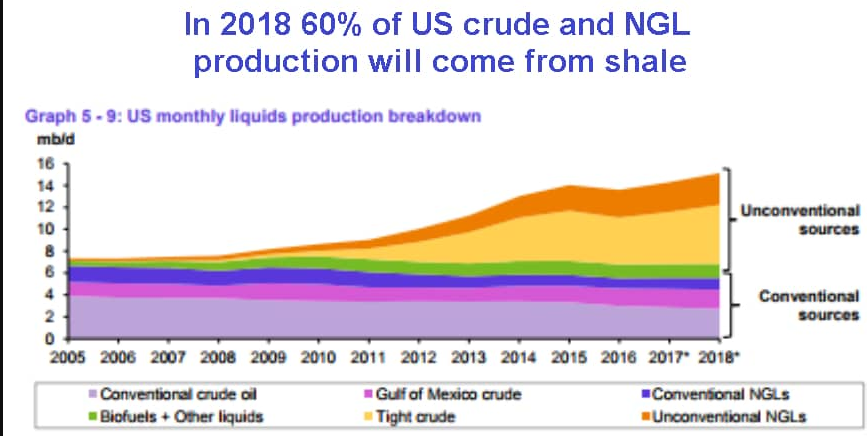

- Unconventional sources of oil are now on the Market - the long term viability of these unconventional sources is currently unknown. This production started to ramp up around 2009, for context, remember that world consumption is about 90 MBD So the Canadians are somewhat crazy in their rush to produce more oil out of Tar Sands (covered later as well) as the total yield is rather small compared to 90 million barrells per day.

Note that the above figure assumes Oil Sands Growth in the future - this is extremely unliklely to occur and so 4 MBD seems like a good estimate for the future.

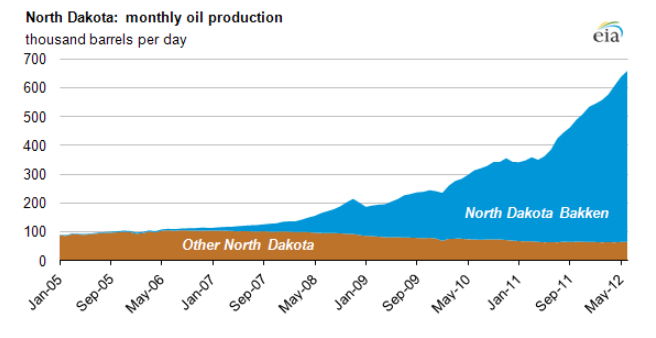

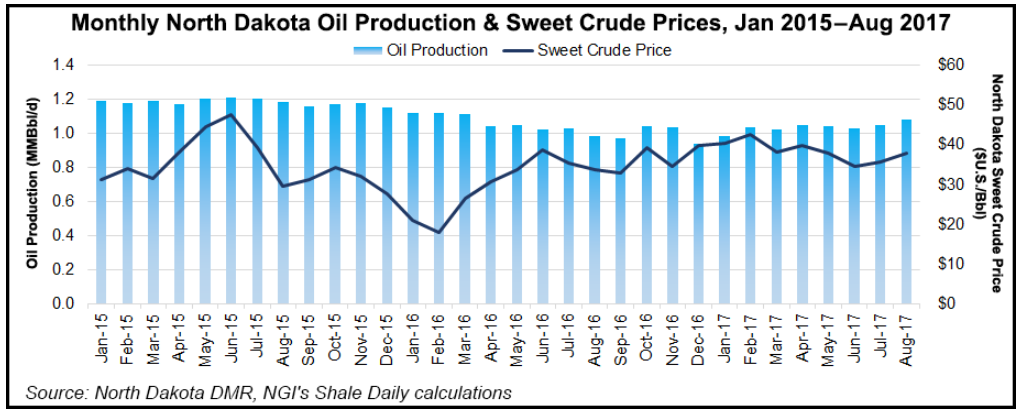

For the North Dakota fields, peak production likely has already occurred: Early indications showed a Hubbert like Curve. From that data and estimates of R (what is left to harvest) Peak production would have been predicted to occur around 2015/16 (and of course no one believes this because this is supposed to be a long term resource).

Recent data indicate that peak has occurred and now the plateau phase has been entered.

Indeed 2016 production data shows that the boom may be over although the data are certainly not definitive (yet).

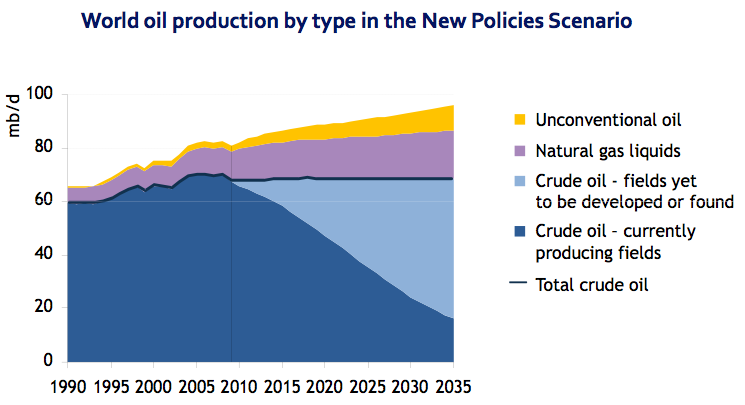

While the yield of non-conventional oil sources remains somewhat unclear; what is crystal clear is that any increases in fossil fuel base to meet increasing demand will not come from conventional crude oil.

The future seems to rely, almost totally, on unconventional oil sources being available. We will critically examine this in the next section on Fracking.

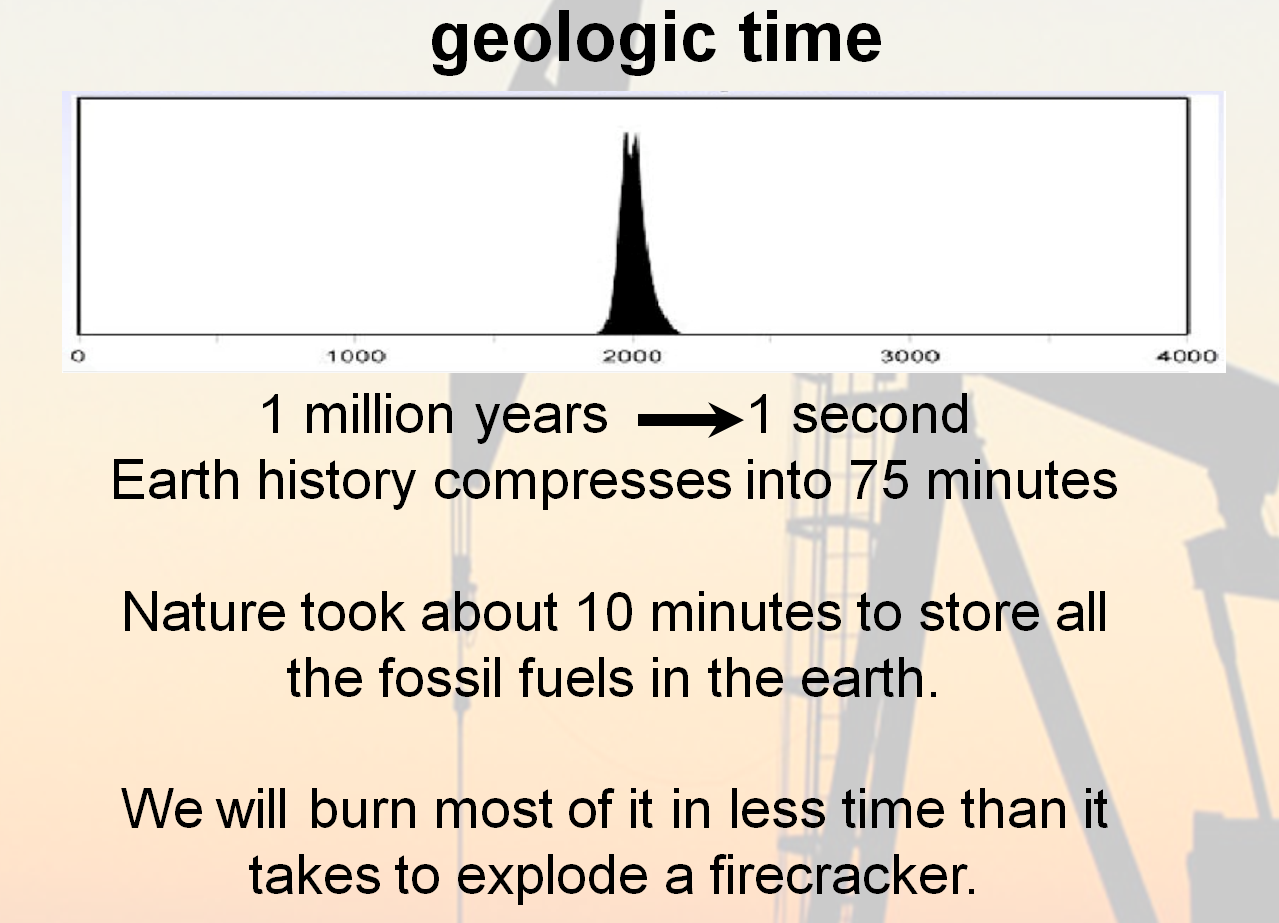

And keep in mind the external, geologic time view of our fossil fuel era. Doesn't make a lot of sense from that perspective:

The most up to date data on global supply and demand can be found here:

The Monthly Oil Market Report is most up to date.

|