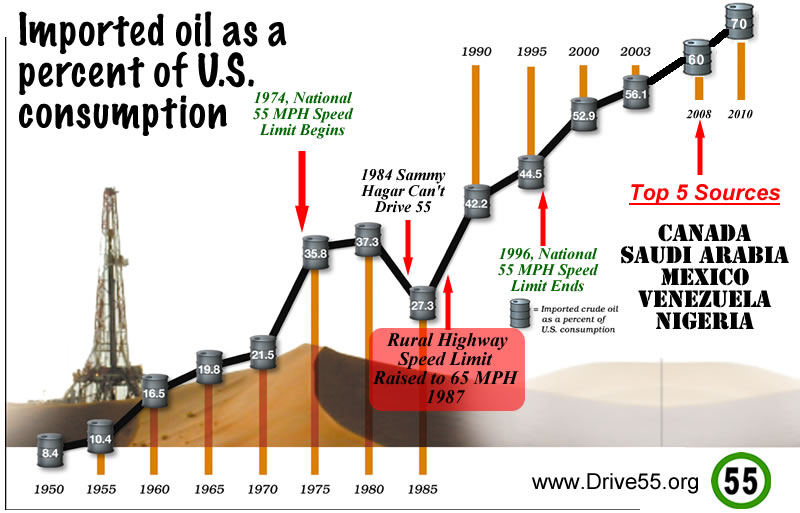

This meant we no longer had to push on fuel economy standards so we didn't (side note: if by 1995 the average fuel economy was 45 mpg then our dependence on foreign oil would have dropped to about 10%; in 2010 we will import 70% of of our total oil)

Out of the 42 gallons of crude oil, somewhere between 19 and 21 gallons of gasoline can be produced.

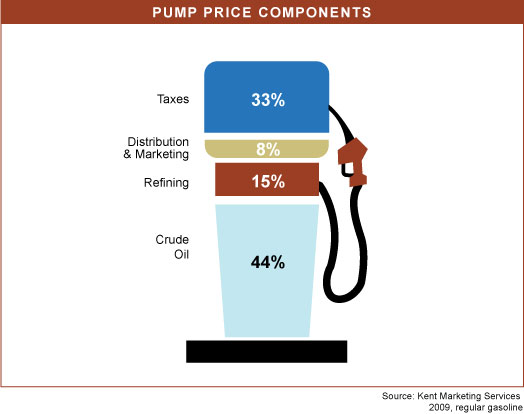

The actual profit margin for gas is low but the high volume means that large revenue is generated.